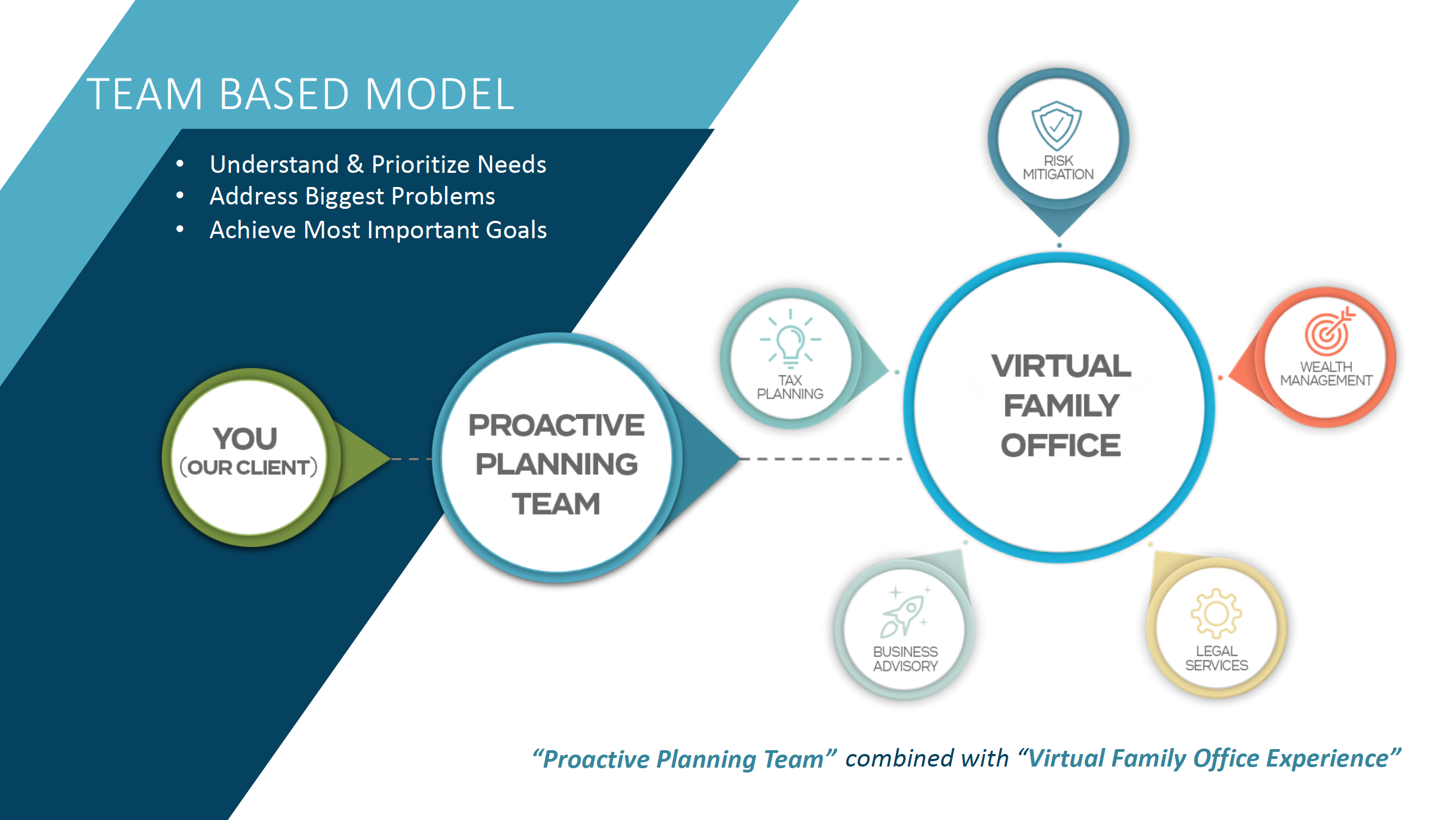

At Tax Free Wealth Group, in addition to our range of financial planning services, we provide you with a Virtual Family Office of experts, which combine the following five disciplines to provide you with truly PROACTIVE and HOLISTIC planning to ensure that you will be MAXIMIZING YOUR POTENTIAL:

- Wealth Management

- Tax Planning

- Risk Mitigation

- Legal Services

- Business Advisory

Upcoming Events

There are currently no upcoming events.

Meet Our Team

Your local “eyes and ears” to help you focus on planning priorities and identify opportunities.

Your national experts that provide the “best of the best” in tax planning, legal, risk mitigation, wealth management, and business advisory services.

Combining Proactive Planning and the Virtual Family Office Experience.

We recognize that our best clients want PROACTIVE and HOLISTIC planning.

That is why at Tax Free Wealth Group we have upgraded to a 21st century business model based around HOLISTIC and PROACTIVE advice, and are supported by a Virtual Family Office of experts.